BBC News and a file on 4 investigations

BBC

BBCChristmas 2011 was a year after Roman Abramovich was delivered to the new super yacht, Eclipse. But it seems that the few will not use it during the ceremonial period – the records show that they were rented by a company based in the British Virgin Islands.

However, photographs from Christmas day that year show Mr. Abramovich under the Caribbean sunlight, where they stand on the swimming platform in the back of the yacht, with the large Eclipse logo of the back.

The charter records like this were part of a decade -long scheme to mislead the tax authorities, which have now been discovered in an investigation by the BBC and Investigative Press Office.

The scheme has falsely presented the Russian -few yacht fleet as a commercial rental process, to avoid millions of euros in the value -added tax on purchase and operation costs.

“There was tax evasion,” Italian tax lawyer and Professor Thomaso de Tano told the BBC. “This is a criminal.”

In a statement, the lawyers of Mr. Abramovich – who is said to divide his time between Istanbul Will Obab and the Russian resort in Sochi – said he “has always got independent professional taxes” and “he behaves according to.”

The billionaire, which was approved by the United Kingdom in March 2022, bought a relationship with Vladimir Putin, five luxury yachts over the 2000s that participated in the tax scheme.

Among them was Bilorus 115 meters (377 feet), which was said to have been presented by a football player in Chelsea John Terry to spend the honeymoon in 2007 – and Eclipse, which was in 162.5 meters (533 feet) one day the largest private yacht in the world and its value. 700 million dollars (559 million pounds).

The tax avoidance scheme – and other secrets from the Empire of Al -Qalaa Company that has been approved – is placed in more than 400,000 files and 72000 email messages leaked from the Cyprusx Service provider, MERISERSERVUS.

They explain how MERISSERVUS managed the actions of the few through a global network of companies owned by a series of funds that Mr. Abramovich was the beneficiary.

The British Broadcasting Corporation and its media partners, including the Guardian, reported the files that have been leaked since 2023 as part of the International Federation of Journalists Investigation. Cyprus is a secret investigation. We previously revealed Mr. Abramovich’s financial links to a relative of Mr. PutinAccused of retaining the president’s wealth.

The files reveal how Mr. Abramovic’s advisers helped him to avoid paying huge tax bills for running in yachts in the waters of the European Union using companies to employ them or other companies controlling them.

The documents show how the five yachts were rented for a company in Cyprus called Blue Ocean Yacht Management, which I rented into a handful of companies in the British Virgin Islands that seemed independent – but it was actually controlled by Mr. Abramovich.

“You realize risks”

The VAT Training Plan was set in Cyprus in the 2005 Memorandum on the proposed “Employment Temple” of the Yacht Administration, Mr. Abramovich.

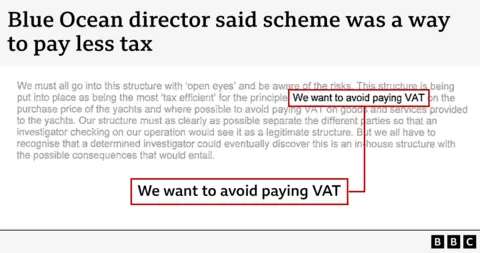

“We want to avoid paying the value -added tax on the purchase price of yachts and the place to avoid paying the value -added tax on the goods and services provided to yacht,” wrote the author of the memo, Jonathan Holway.

Although Blue Ocean and the companies that employ yachts were fully owned by Mr. Abramovich’s fund Partners of Mr. Abramovich.

Mr. Holwai warned them that they were “familiar with risks.” He wrote: “We all have to realize that the designer investigator can ultimately discover that this is an internal structure with the potential consequences that may require.”

Mr. Holwai wrote that Blue Ocean, the companies that have rented the yacht, and the final “customer” should not have the same shareholders, directors or recorded addresses, to avoid any “joint link” that may cause doubt.

As the memo noted, Mr. Abramovic’s lawyer agreed to put the ownership of the Blue Ocean in completely separate confidence – apparently distanced from other companies.

The ownership of the Yacht Blue Ocean Management Company was definitely transferred from the main oligarchic fund to a new one, The Neptuune Trust.

“Hide reality”

Professor de Tano told the BBC that the way the Ebamovic yacht companies rented each other, was an “artificial structure” escaping from the tax – a criminal crime.

“My conclusion is that in this case, there was tax evasion … because all parties know exactly what to do in order to hide the reality,” he said.

Tax expert Rita de La Veria told the British Broadcasting Corporation that she had seen in the yacht scheme “indicators” as “might be a distortion of information.”

“If this is the case, we will now be in the world of evasion,” she added.

“He joined Ocean Blue 20 years ago and was there for a relatively short period of time.”

He said, “literally managed hundreds of ships from many different sites around the world,” he said. “I cannot expect to remember the individual circumstances of every ship that I was able to manage at all,” he said, adding that he “used the structures that others use in the industry.”

Lawyers representing Mr. Abramovich BBC told that he denied “any claim that he had any knowledge” or “personally responsible” or responsible for “any alleged deception of any governmental authority” to evade the tax.

His lawyers said that just as Mr. Abramovich sought and behaved legal and tax advice on it, it is expected that “similar advice at relevant times by those who bear the responsibility for daily running” for companies participating in a plan.

If these real business is the rental, it may be expected to be great profits. However, Blue Ocean accounts show that from 2005 to 2012, her expenses were almost identical to her income.

This means that there was almost no tax on companies because the company’s profits were small.

A note from Ocean Blue Ocean manager indicates that the close match of expenditures and income was not coincidental and that the company will generate charters when the scheme needed to cover the expenses.

“At the beginning of each week, we will have a meeting at Blue Ocean where we will look at the current banks’ balances and meet our cash needs for 1 to the following two weeks [sic]. If we see a need for cash injection, we will raise an appropriate charter and bills. “

There is also evidence in the leaked files that the Charter Conventions were suspended. This includes the time agreement that is supposed to be signed in July 2005 by Blue Ocean and another Bvi’s Abramovich company called Eyke Services. However, records show that EYKE services were not present at that stage – they were not merged until a month later.

In another case, the Blue Ocean manager requested the production of a signed timetable for obtaining a delivery of fees exempt from Mr. Abramovich 86 meters (282 feet) – which can accommodate 15 guests in eight wings – saving the billionaire $ 44,000 (35,000 pounds Sterling) in taxes.

In the documents, tax consultants wrote from Deloitte in Cyprus to Mr. Holwai, director of the Blue Ocean, saying that if the ships are fun ships, they will have to pay the value -added tax. But if the ships are classified as commercial, you will not do it.

The luxury yacht lawyer, Benjamin Maltebe BBC, told the type of contracts used in many luxurious yachts ’charters from Mr. Abramovic, which was actually designed for commercial ships carrying dry Cargo, such as grains or steel.

This gives us more evidence that the entire “appearance” of the operation was a trick.

“Lawyers have obtained this.”

The super yacht scheme is presented to Mr. Abramovich twice, with different levels of success, informed BBC and the Investigative Press Office.

Richard Bridge seized two yachts of Mr. Abramovich for approximately six years from 2006 to 2012, including Piloros, the giant eclipse, the pride of the Abramovic fleet. Two years after the completion of the work of Mr. Abramovich, the captain was stopped and interrogated at the Sheboul Airport in Amsterdam.

Italian public prosecutors began action against three of Captain Mr. Abramovich – including Mr. Bridge – due to the duties of unpaid consumption to refuel and tax evasion.

But Mr. Bridge told the BBC that he called Blue Ocean and “their lawyers got it,” and after a few months he told him that the case had been dropped.

The records of the Italian court, which witnessed the procedures of the BBC exhibition, were stopped after the “documents that were produced” were produced that proved that Piloros “was entered into the records as commercial relatives where it is used for commercial or rental purposes.

Gety pictures

Gety picturesMr. Bridge said he was not aware of Mr. Abramovic also controlling companies that hired yachts.

In Cyprus, tax officials were investigating more than 17 million euros (14.3 million pounds) in the unpaid value -added tax, which is disputed by the company’s demand that it is a “zero classification” for VAT because it was a commercial process.

Blue Ocean’s lawyers said that the demands for providing evidence that ships were used commercially by the companies that rent them were “unreasonable and repressive”, but they asked their customers anyway and did not receive any response.

We now know that Blue Ocean customers were, of course, Mr. Abramovic’s other companies.

According to the appeal rule in 2018, VAT investigators found that Blue Ocean had failed to provide any evidence that companies that rent yachts are “involved in economic activity” and that the claim that boats had been rejected for commercial purposes.

In the end, Cyprus continued the Blue Ocean for 14 million euros (11.8 million pounds).

We do not know if the amount was paid – the company failed to appeal in March 2024 and was resolved after four months.

Cyprus is a secret It is an international cooperative investigation launched in 2023 led by the International Federation of Investigative Journalists (ICIG) in Cyprus companies that provided companies and financial services to the regime of Russian President Vladimir Putin.

Among the media partners, The Guardian, The Investigative BAPER TRILEDIA, the Italian Newspaper l’Presso, a project to report organized crime and corruption (OCRP) and the investigative press office (TBIJ). TBIJ reports team: Simon Locke and Eleanor Rose.

https://ichef.bbci.co.uk/news/1024/branded_news/d7a5/live/231003f0-dcdd-11ef-bc01-8f2c83dad217.jpg

2025-01-28 06:00:00